Photo: Shutterstock

Credit cards are marketed in so many dizzying ways that it can be hard keeping track of their perks and privileges.

And with so many added conditions like minimum spends and qualifying transactions, trying to decide which card to use can be downright confusing.

Which is a bit of a pity, because your credit cards hold the key to some truly fantastic dining privileges and discounts.

Here’s your cheat sheet to help you get the most value from your credit cards, according to your dining habits.

1. For Gourmet Meals: American Express Platinum Series Credit Cards

Photo: American Express website

Dining out is best enjoyed in groups; not only will you get the chance to order more than usual, you also get to split the bill. And if you play it right, you can get a whopping 50 per cent discount on your fine dining or hotel buffet meal. Suddenly, a steak dinner at Lawry’s doesn’t seem that unaffordable.

That’s all possible with the American Express Love Dining programme, an F&B focused privilege programme that slashes the dining bill for you and your dining buddies by up to half. Refer to the table below for details:

American Express Love Dining Privileges

DiningWith 1 guestWith 2 guestsWith 3 guestsWith 4 – 19 guestsAlone

Discount 50%35%25%20%15%

The discount applies when you order qualifying items, which may differ between establishments, but otherwise there are no limits nor minimum spends.

You can make use of these privileges as long as you pay with a valid American Express Platinum Card (including the Amex Platinum Credit Card, the Amex Platinum Reserve Credit Card and The Platinum Card by Amex — yep they’re all different cards. Naming things is hard, you guys!)

Oh, we haven’t told you what the Love Dining programme covers? Only some of the best restaurants and hotels in Singapore, including Michelin Star winners like The Song of India, and chi-chi hangouts like W Hotel and St Regis. This, here, could be the key to the tai tai life.

2. For Stay-Home Dining: OCBC 365 Credit Card

Photo: OCBC website

If your idea of the perfect holiday is to stay at home binge-watching Brooklyn Nine-Nine, then like us, you think Foodpanda and Netflix were made for each other. Might as well optimise this (un)holy pairing by making sure you use the best credit card for the situation.

And our pick for ordering food as quick as we can (because the next episode is starting, hurry!) goes to the OCBC 365 Credit Card. A somewhat surprising choice because this card is designed to be an ‘everyday savings’ card, i.e., meant to rack up your rebates across a wide variety of spends.

But hear us out. With a juicy 6 per cent rebate on all dining spends, all day, everyday — and yes food delivery is included – your anti-social lifestyle actually gives you a solid chance of earning consistent savings with this credit card.

You do have to spend at least $800 per month with this card to qualify for cashback (capped at $80 per month) though, so maybe go out and buy yourself some fresh fruit and also toiletries once in a while? (You’ll get 3 per cent cashback for groceries!)

3. For Weekend Cafe Hopping: UOB YOLO Card

Photo: UOB website

Keeping up with the never-ending slew of hipster cafes, liquid buffets and pop-up restaurants can be expensive, especially when you happen to be young and carefree (with your bank account). But c’mon, it’s not a proper weekend unless it involves Eggs Benedict, wood-fired pizzas and whatever latest artisanal creations tarting it up on Instagram.

You’ve worked hard all week, and deserve to indulge yourself when the weekend rolls around. Well, we recommend bringing the UOB YOLO Card when you inevitably cut loose.

What for? Why, to earn 8 per cent cashback on all your weekend dining of course, saving up to $60 per month this way (that’s at least two hipster cafe visits — three if you skip the nitro brew!)

Note that this 8 per cent cashback on weekend dining (3 per cent on weekdays) is valid only if you charge at least $600 to the card in a statement cycle. However, you also get up to 8 per cent cashback on online shopping, Grab rides and entertainment spends, so meeting the minimum spend actually makes for quite an attractive prospect.

4. For Family Banquets: HSBC Advance Credit Card

Photo: HSBC website

You love nothing more than getting the whole family — all three generations of them — to feast together at your favourite restaurant, and picking up the bill is your way of showing everyone how much you love them.

We say spread a little of that love back to yourself with the HSBC Advance Credit Card, which can give you up to 3.5 per cent in cash rebates (capped at $125 per month) on your banquet bill (and also all other spends).

Now there are some hoops to jump through in order to earn what is currently the highest credit card monthly cashback on the market, but the savings are worth it.

Here’s what you need to do. Beside applying for the Advance Credit Card, you should also open an Advance Banking account with HSBC, which qualifies you for $125 max cashback in a month (up from $75), and gives you an additional 1 per cent cashback.

Then, when you charge at least $2,000 to your Advance Credit Card (like at your annual family banquet), you’ll earn 3.5 per cent cashback on all your transactions that month. Not bad, right?

Spending less than $2,000 in a month entitles you to 2.5 per cent cashback on all transactions as an Advance Banking customer.

If you have only the credit card, and spend less than $2,000, you can still earn 1.5 per cent rebate across all your transactions. Spend more than $2,000, and you’ll be bumped up to 2.5 per cent rebate. However, the maximum cashback per month is capped at $75 only for those without an Advance Banking account.

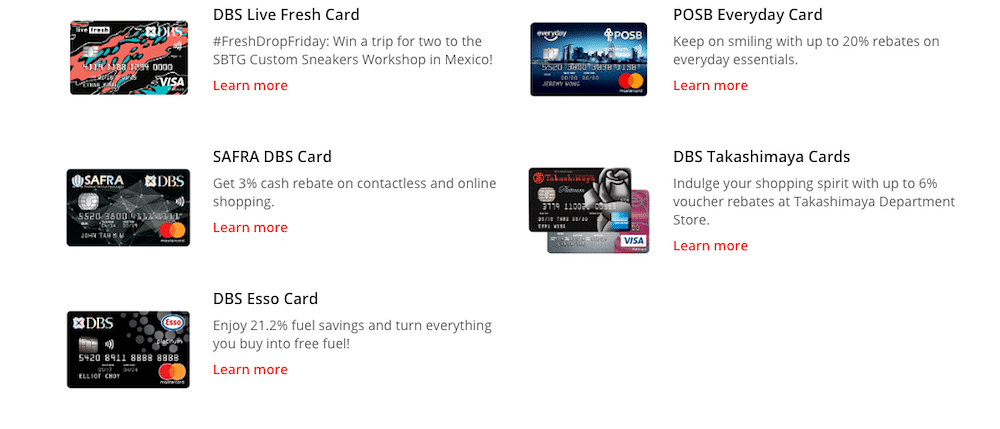

5. For Buffet Feasts: DBS/POSB Credit Cards

Photo: DBS website

Sometimes you just need to pamper yourself, and in a foodie paradise like Singapore, what better way to do so than by treating yourself to a buffet or two?

Be it a smorgasbord featuring top cuisines from around the world, or exotically themed feasts that only happen once-in-a-blue-moon, you’ll be spoilt for choice when it comes to your next gourmand fix.

One of the most reliable ways to keep your feasting from getting too expensive is to pay less than full price. And for this, DBS/POSB credit cards are your best bet. As of this writing, you can get 1-for-1 offers at no less than eight buffet lunches, dinners and high-teas across established hotels such as Amara, Westin, Marriott, Mandarin Orchard and more.

And best of all, these deals are part of your cardholder privileges. So to enjoy them, all you have to do is to reserve and pay with a valid credit card from DBS or POSB.

Bon appetit!

ALSO READ: UNDER THE AGE OF 40? THIS IS HOW BUDGET 2019 WILL BENEFIT YOU