Picture: epicstockmedia / 123rf

The time has come. Your trusty family ride is nearing its 10-year mark, which can only mean one thing – do you renew the Certificate of Entitlement (COE) for another five or 10 years, or scrap it and enter the market for a used or new car?

With the astronomical prices in Singapore, it’s a question that keeps owners up at night.

Apart from the pull of emotional factors, David Ting, editor of Torque, advises asking yourself the following:

• How much of a down payment can you afford to fork out?

• How much are you prepared to pay for monthly instalments?• How much of a depreciation are you willing to accept?

To help make that decision less nerve-wracking, we lay down the key considerations involved.

Read Also: The health insurance policies you need at every age

1) Upfront Costs

Renew COE Premium or PQP, which is the moving average of COE prices in the last three months. The PQP for Category A cars (up to 1,600cc and 130bhp) ranged between $56,633 (Jan) and $45,578 (May). For Category B cars (above 1,600cc or 130bhp), the range was between $58,615 (Jan) and $46,048 (May). These should help you see how much PQP you can expect to pay.

You can renew for five or 10 years: For five years, you pay 50 per cent of the current PQP, but will have to scrap your car once the term is up. For 10, you pay the full PQP and, at the end of the term, can either deregister your vehicle or extend the COE for another 10 years.

The PQP payable will be the rate for the month in which the COE expires. If renewal is done before the current COE expiry month, the PQP payable will be the rate at the time of the renewal. • If you don’t renew your COE by the time it expires (or up to one month after), your vehicle will automatically be deregistered.

Buy a used car You can get a loan of up to 70 per cent of the car price for a maximum of seven years, and pay the balance in cash. There is no need to pay more for a COE as the used car has a COE tied to it.

Buy a new car Pay the 30 to 40 per cent of the car price as a down payment and get a loan for the balance over a maximum of seven years. The loan amount you can get depends on the car’s Open Market Value (OMV), which is assigned to all new cars by Singapore Customs. It is based on the cost price of the car and other charges, like freight and insurance, related to the sale and delivery of the car in Singapore.

If you are buying a car with an OMV of $20,000 and below, you can borrow up to 70 per cent of the car price. If your new car’s OMV is above $20,000, your maximum loan amount is 60 per cent.

Read Also: The best credit cards for chalking up air miles, based on your travel habits

2) Your Car Maintenance

Renew COE Servicing costs depend on how well you’ve maintained your car over the past decade, and takes into account the fact that most vehicles will require parts replacement and minor repairs to ensure they run smoothly.

David estimates: “Buyers will need to budget $1,000 a year for a sub-2,000cc Japanese or Korean car, and $2,000 for a sub-2,000cc European car.” Also, don’t forget to set aside funds for the replacement or repair of major parts, such as transmission and suspension components, he adds.

Buy a car New cars are covered by the manufacturer’s warranty, typically for the first three years or 100,000km travelled. However, some authorised car dealers, like Honda, are offering a five-year unlimited mileage warranty. Maintenance costs for used cars also vary, depending on their age and condition.

3) Road tax surcharge

For a car over 10 years old, you pay an additional 10 per cent in road tax every year from the 10th to 14th year. From the 14th year, the surcharge will stay at 50 per cent until the end of the COE term. For instance, if you were paying $742 for a Toyota Corolla Altis, your road tax in the 10th year would be $816, and $1,113 from the 14th year onwards.

Read Also: Smart ways to save on car insurance in Singapore

4) Insurance

Renew COE Some insurers offer comprehensive insurance for cars up to 15 years old. Anything beyond that is restricted to Third Party, Fire and Theft, and Third Party Only insurance, says Nikki Tay, manager of motor insurance specialist Inxure Network Services. She adds that, on average, the insurance premium for a COE-renewed car is 10 to 20 per cent higher than that for a new or used car.

Buy a car For used cars under 10 years old and new cars, there is a full range of insurance, from Comprehensive to Third Party, Fire and Theft, and Third Party Only insurance.

5) Depreciation

Generally, depreciation (or the drop in value of an asset over time) will be lowest for a COE-renewed car as opposed to a new or used car.

Read Also: Compare travel, health and car insurance in seconds with GoBear

6) Rebates

Renew COE Be prepared to forfeit the Preferential Additional Registration Fee (PARF) rebate, or scrap value of your car, when you renew your COE. The PARF is a percentage of the car’s OMV. Check your car’s OMV and PARF rebate at www.onemotoring.com.sg. The only rebate a COE-renewed car is entitled to is the balance of the COE – provided it is scrapped before the end of its term.

Buy a car If you deregister your current car to buy a new or used one, you can use the PARF rebate to offset the price of the next vehicle. You are also entitled to a COE rebate if you deregister your current car before it hits the 10-year mark.

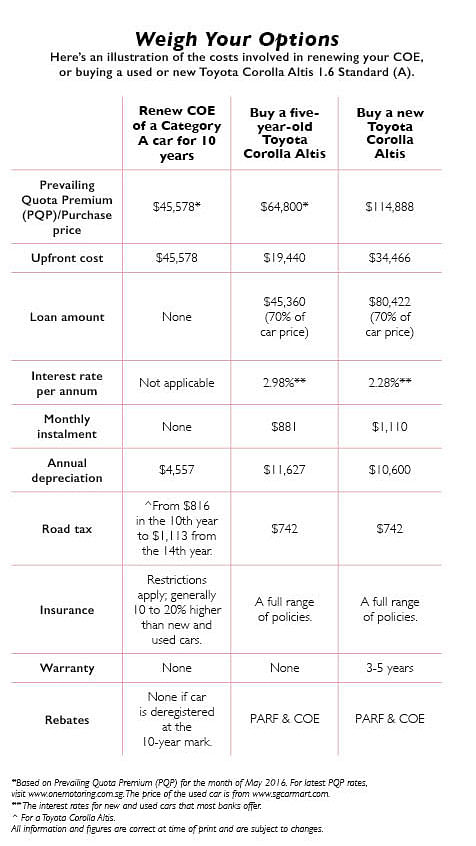

The following table illustrates the cost of the options.